Originally posted in Financial Advisor (fa-mag.com) on July 1, 2020.

On a recent trip to Alaska to see my son, a park ranger, I asked him about how officers like him are trained to respond in the most stressful and chaotic situations. In triage training, for example, when a gunshot victim is bleeding out, officers have to properly apply a tourniquet while the victim is screaming, sirens are blaring, firecrackers are going off, and a scene of absolute chaos is simulated—all within 90 seconds if the shot is to the arm and 40 seconds if the shot is to the lower abdomen. The officers practice these techniques over and over until they can do them on automatic pilot. My son summed it up: “A person always defaults to their highest level of training.”

I realized that financial professionals, by and large, lack such training, even though every few years or so we are thrown into chaotic and uncertain periods in which clients are caught up in noise and disturbance. Advisors are expected by instinct to calm clients in storms. But it’s not that natural or easy

Hopefully, during the most recent turmoil with the coronavirus pandemic, you have been drawing on your past “training” experiences in the Great Recession, the dot-com debacle, or any other uncertain and volatile periods you have endured. What have you learned about bringing calm and restoring perspective?

A Lifeline

I clearly remember the protocol I taught in my former life as the director of a suicide help line. When training counselors to deal with callers, I told them to make sure their tone was calm though concerned, normalizing and accepting. The counselors then had to go through the following steps:

1. The first was to thank the callers for talking. This is a necessary step for breaking through the ideation web they were caught up in and acknowledging their courage in making the call.

2. Next, the counselors had to “unwind the story.” They needed to ask the callers what had brought them to that point.

3. Third, counselors had to “widen the circle.” They had to ask the callers who would be most impacted by their actions. This decision wasn’t just about them.

4. Fourth, the counselors had to bring some perspective. Suicide is a permanent answer to a temporary problem.

5. And lastly, counselors had to help the callers find a way forward. What was it that was fixable, and what must they accept?

Although not all of your clients are facing life and death issues, I don’t think this framework will be much different in the dialogues you’ll be having with them. Consider a similar set of steps you’ll be using when dealing with clients:

1. Thank them for talking. Social distancing doesn’t mean you don’t stay in touch. This conversation will be good for both you and your clients.

2. Unwind the story. Every client will have an answer when you ask them how this situation has affected them. Amid the turmoil in 2009, philosopher and theologian Jacob Needleman said, “People need to know that they’ve been heard.” They don’t need pat answers, platitudes or predictions. They just need to be heard.

I’ve heard many advisors admit: “I have trouble not talking all the time. I’m afraid of my clients not having an answer to my questions, so I just talk.”

If you’re going to ask a deeper or more searching question, preface it with, “You may not have an immediate answer to my question, but I’m curious to know …” This way, you’re indicating your concern for them and giving permission for silence to exist in the conversation.

Every client has a singular story. Find their story. Let them know they’ve been heard.

3. Widen the circle. How has the situation impacted your clients’ family members? How has it impacted their career or business? How has it impacted their future plans?

4. Bring some perspective. We don’t want any permanent answers for temporary situations, and there may be clients inclined to self-sabotage. If that’s the case, you may have to bring up the old charts showing how markets have survived through all the historic events of the last 50 to 100 years. Markets will survive this reality as well.

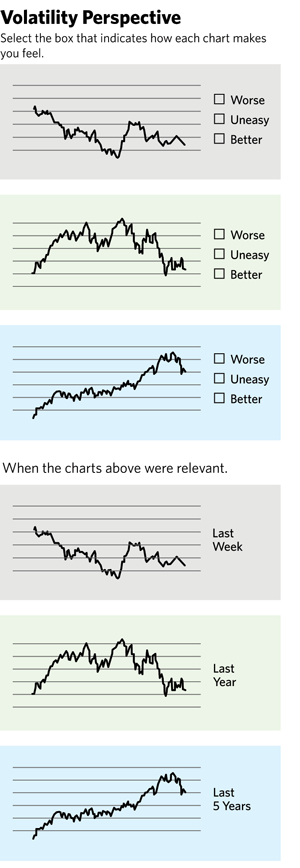

The graphic belo is one I created back in 2009 to help clients gain some perspective. In the first illustration, they are asked to mark how the chart would make them feel if it was their money being discussed: worse, uneasy, or better. Typically, clients label the first chart “worse,” the second “uneasy” and the third “better.”

When they look at the next chart, they see the punch line: They are looking at the same stock (or fund), and it’s simply the time perspective they have chosen that has caused them to feel worse, uneasy, or better.

5. Find a way forward. Perhaps some of your clients’ plans have changed. Perhaps their attitude toward investing, insurance, retirement, debt, spending or some other financial issue has changed. This is a time to take their temperature and be proactive and discuss any shifts they are making in their thinking or life plan. Here you can talk about what is “fixable” and what we must accept, as well as asking “What do we know, and what do we not know?”

Portfolios fluctuate, but lifestyles veer and sometimes swerve. And it’s lives that we must tune into at this moment in history. The portfolios will find their way back over time, as we’ve seen time and again. But lives may never be the same.

Those who expect to return to the status quo may find that the “quo” has been decidedly altered. It’s our job to show up in the now and sort out each client’s present reality … and there’s no time like the present.

Mitch Anthony is the creator of Life-Centered Planning, the author of 12 books for advisors, and the co-founder of ROLadvisor.com and LifeCenteredPlanners.com.