by Mitch Anthony

“Shoot for the moon. Even if you miss, you’ll land among the stars.”—Les Brown

According to Alite Group, one of the top ten disruptors in the financial services industry this year is “holistic wealth management”. This means that more and more advisors are realizing that robo advising, fees, and changing client demographics indicate they need to find a way to stand out in a “me-too marketplace.”

Holistic wealth management is based on an investor’s individual goals. Alite Group’s Meghna Mukerjee commented: “In 2018, goals-based financial planning will take center stage, and though this is by no means a new concept for wealth management industry, most financial institutions will have renewed focus on getting it right this year.” One of the key objectives listed for this trend is “strengthening tailored advice and outcome-oriented portfolio construction.”

A dialogue focused around a client’s goals is a critical and necessary part of any financial planning discussion and is essential for advisors who are transitioning to life-centered planning™––one that is based on the concepts of Return on Life™.

When engaged in a dialogue with clients, it’s important to help them distinguish between goals and transitions. Goals are proactive choices they make: helping a family member attend college or start a business, setting up a foundation, taking a trip. Transitions are the more reactive life events they experience and react to: losing a loved one, getting a divorce, losing a job or starting a new job, relocating to a new city or town. Each transition requires planning, because clients need to be prepared for both the expected and the unexpected––and chances are, they will overlap one or more times.

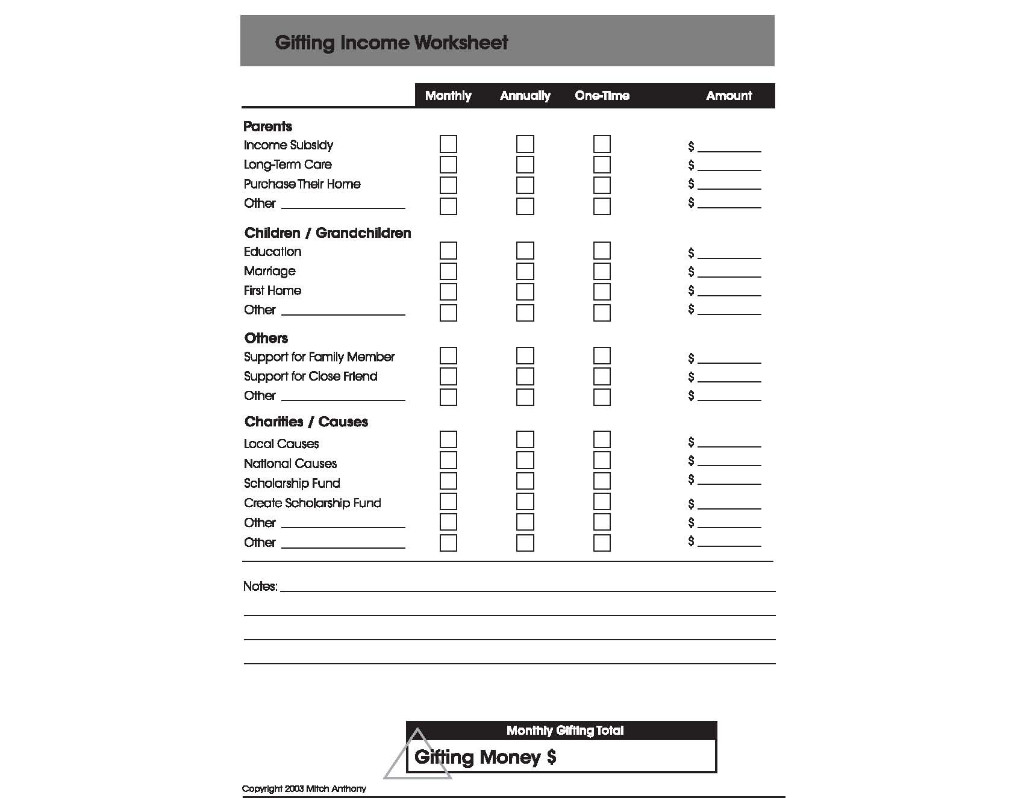

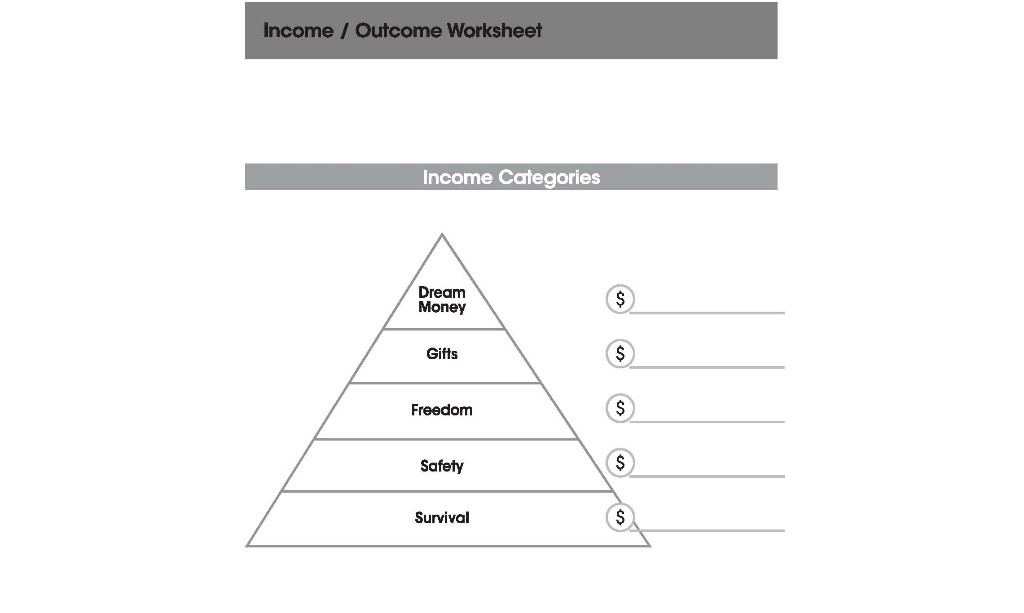

Here are a couple of tools to help you start a dialogue with your clients centered on their goals. Both are from my book, The New Retirementality, Fourth Edition. In a future issue of the newsletter, we’ll discussion transitions.

Have your clients complete the “Gifting Income” and “Dream” worksheets before you meet with them. When you sit down with your clients, utilize their responses to start the conversation about goals. At this point, have them ignore assigning dollars to their goals. The objective of the exercise is to get everything down on paper so you can develop a plan that works for them.

Here are a few examples of goals: Taking a family trip, helping a family member financially (i.e., home purchase, tuition assistance, long-term care), starting a business, starting a family, expanding an existing business. As you can see, goals tend to be more discretionary and optional—many goals are “bucket list” items.

Every client is idiosyncratic, which is why life-centered planning revolves around goals and transitions, instead of focusing on assets alone. Given a choice, most of your clients will prefer not retiring, but instead, living the best life possible with the money they have.

Having a clear focus on their goals and transitions will help both of you achieve a plan that revolves around life…and not vice-versa.

© 2017 Mitch Anthony

Mitch Anthony advises financial services organizations throughout the world. An industry pioneer, he is a popular speaker and consultant, and the developer of MyFLPTools, a subscription-based service that provides a suite of discovery tools for financial services professionals. He and Steve Sanduski have developed the Retirement Coaching Program and ROL Advisor to help advisors build a Life-Centered Planning™ practice. A regular contributor to Financial Advisor magazine, Mitch is the author of more than a dozen books including the industry bestseller, StorySelling for Financial Advisors and The New Retirementality, now in its fourth edition. Contact Mitch at [email protected] or visit www.mitchanthony.com.