Originally posted at forbes.com, by David John Marotta, on November 11, 2019.

As clients get older, they often start to feel obligated to retire. They love working, but they are 65 or older and all their friends are doing it. The traditional concept of retirement is called a “cliff retirement” because it is so abrupt. One day you are working full time, and the next you are recreating full time.

However, there are many social and health benefits to delaying retirement and continuing to work. We all need meaning and significance in our lives. We all need close social relations. For many of us, work provides these. It is not simply what you do in order to make money; it is your vocation.

In addition to these benefits, there are also significant financial benefits to delaying retirement. Continuing to work for five more years could increase your retirement standard of living by as much as 50%.

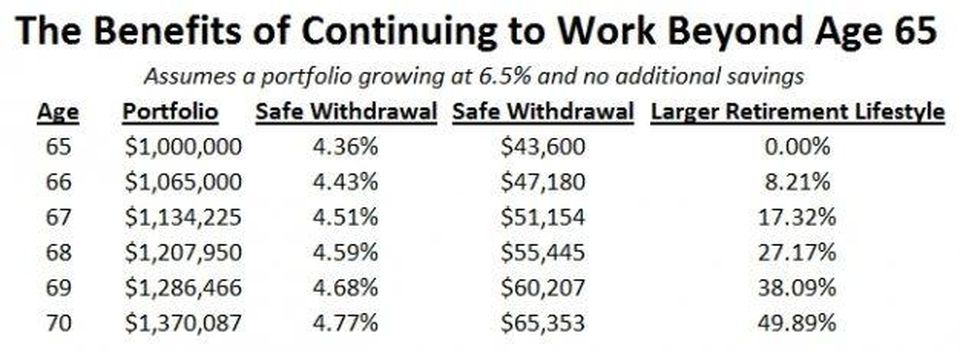

Imagine a client who has a $1 million portfolio and is able to retire at age 65. Using our maximum safe withdrawal rate percentage for age 65 of 4.36%, that means that she has a $43,600 annual standard of living.

She is faced with a choice: retire at 65 or cut back her hours and continue working part-time. In either case, she is not going to contribute any new money to her retirement. However, continuing to work enriches her finances in two ways.

First, even without any additional retirement savings, working enough to cover her lifestyle allows her investment portfolio to continue to grow unburdened by retirement withdrawals. For example, if she were to retire 5 years later at age 70, her portfolio would grow to $1.37 million using a 6.5% return (the average real return of the stock market). That is $370,000 more money that she had before.

Second, the safe withdrawal rate at age 70 is higher than at age 65. By age 70, she can withdraw 4.77% of her portfolio. A greater percent of this larger portfolio means she has enough to provide a lifestyle of $65,353. This is about 50% larger than the age 65 safe withdrawal rate.

You can see in this chart how each of the five years progress:

Neither retiring nor delaying retirement is right for everyone. Each family’s case is different.

Some families have no choice but to delay retirement because, at their desired retirement age, their savings are inadequate to support their lifestyle. For those who have a choice, delaying or staggering retirement can mean a higher standard of living and better life planning.

If you do not like your current job, you could consider switching careers to find work that you love. Even if it commands a smaller salary, there are at least two positive effects on your life. First, you gain more life satisfaction as you transition into a career you love. Second, you gain the financial benefit of delaying some or all of the withdrawal burden on your portfolio, taking advantage of compounding gains.

If you are thinking about retirement, we recommend reading The New Retirementality by Mitch Anthony.