by Mitch Anthony

“The shortest period of time lies between the minute you put some money away for a rainy day and the unexpected arrival of rain.”—Jane Bryant Quinn

Last month we discussed the importance of goals in financial planning. This month we’ll focus on transitions. A dialogue focused around a client’s transitions is a critical and necessary part of any financial planning discussion, and it’s essential for advisors who are transitioning to life-centered planning™––one that is based on the concepts of Return on Life™.

In some ways, goals and transitions are the yin and yang of life-centered planning. Goals are usually optional—examples include buying a new car, attending an Ivy League university, buying a vacation home. In other words, goals are proactivebecause your client is making the choice.

Generally speaking, transitions are events that happen to us—a death in the family, divorce, physical or mental disability. In general, transitions are reactive; you don’t usually know about them in advance, so you need to prepare for the worst-case scenario.

Goals and transitions can certainly overlap—your goal may be to start a family, while starting that family is also a transition. Getting married may be a goal, but it is also a transition. Both events represent significant lifestyle changes.

As a life-centered planner, you need to help your clients plan for transitions that can impact them financially—sometimes in a very big way.

When I was researching the costs for six common transitions, there was a large variation in the numbers. For example, a birth could cost next to nothing if a client has health insurance that covers the cost—to $10,000 or more (varies dramatically based on the region, level of complication). Depending on how long it takes to find a new job, a client who finds herself suddenly unemployed may need a couple of weeks’ worth of salary to a year or more. These numbers I’m using here are meant to illustrate how quickly just one of these events can put a hole in someone’s financial plans—and wipe out their savings:

Transition Cost

Getting married $19,000-$33,000 (Cost of a wedding)

Having a baby $10,000 (Health insurance has a big impact on this)

Divorce $15,000-$20,000 (Cost of a contested divorce)

Having a family $245,000 (Cost of raising a child)

Losing a job Six months’ salary

As you can see, any one of these transitions can impact your clients in a very significant way. And this list doesn’t even include retirement planning—one of life’s biggest transitions.

Retirement planning is understandably a critical part of every financial plan—but it shouldn’t be the plan’s sole focus. After all, if you and your clients haven’t had a dialogue about their goals and potential transitions, retirement may not even be an option.

Planning for transitions involves what I refer to as “safety planning” in my book, The New Retirementality:

“What if everything doesn’t work out as you hoped and imagined it would? In life, the one thing we can predict with great assurance is that things will rarely go exactly as planned. It has been said that “life is what happens while we are making plans.” We are surrounded by risks—physical, familial, financial, circumstantial, and relational. Financial risks exist in every category of our lives. Look at the financial risk associated with a divorce—a path that hastens financial ruin, guarantees your assets will be cut in half, and diminishes your saving capacity.”

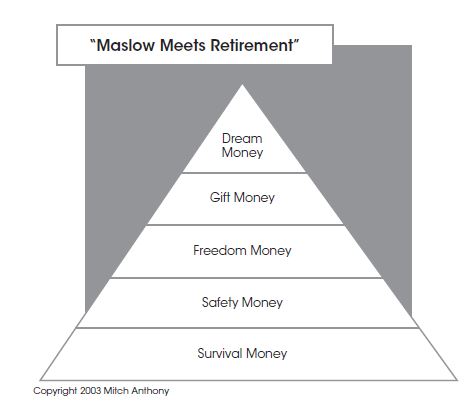

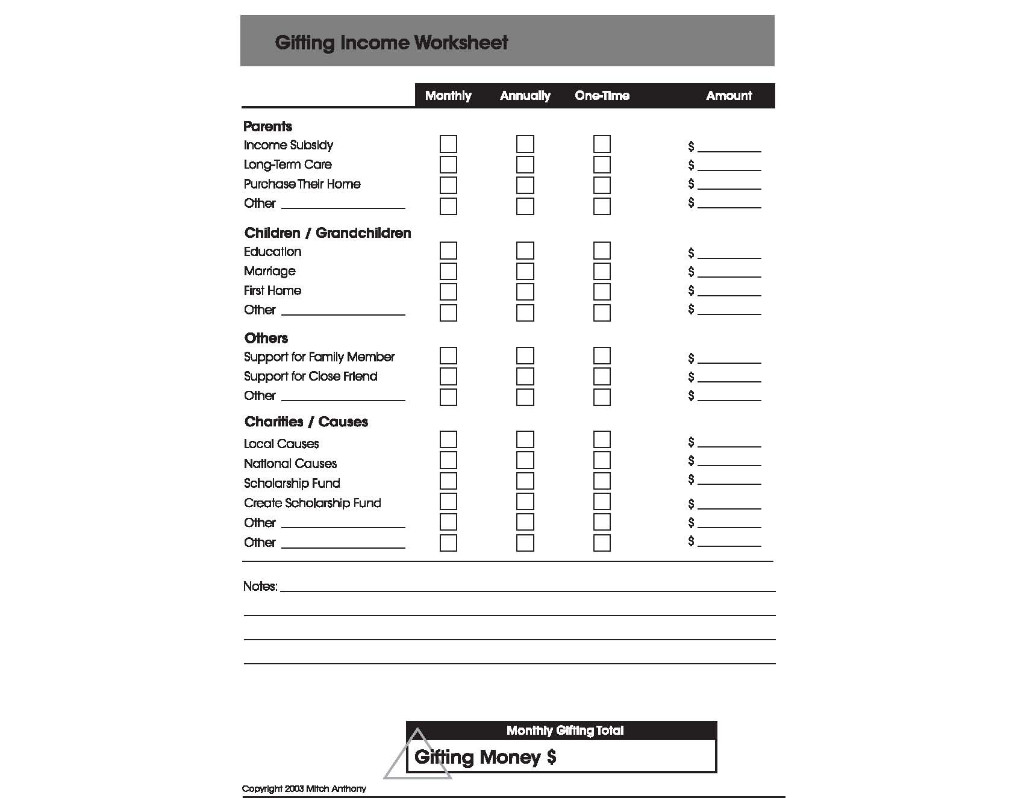

While a dialogue around transitions may not be as easy to have with clients as the one about their goals, it’s just as important. Use the graphic below (“Maslow Meets Retirement”) to help clients see how having properly planned for day-to-day living expenses (“survival money”) and transitions (“safety money”) supports everything else—without that foundation, their financial pyramid will collapse, along with their goals and dreams.

To help you and your clients understand the transitions they may face, use the “Safety Survey” below. Their answers will help you ensure a cushion that will break a fall should the unexpected happen.

Remember, every client is unique––and that is why life-centered planning revolves around goals and transitions, instead of a focus on assets alone. Having a clear focus on their transitions will help both of you achieve a plan that revolves around life…and supports the goals they hope to enjoy.

© 2017 Mitch Anthony

Mitch Anthony advises financial services organizations throughout the world. An industry pioneer, he is a popular speaker and consultant, and the developer of MyFLPTools, a subscription-based service that provides a suite of discovery tools for financial services professionals. He and Steve Sanduski have developed the Retirement Coaching Program and ROL Advisor to help advisors build a Life-Centered Planning™ practice. A regular contributor to Financial Advisor magazine, Mitch is the author of more than a dozen books including the industry bestseller, StorySelling for Financial Advisors and The New Retirementality, now in its fourth edition. Contact Mitch at [email protected] or visit www.mitchanthony.com.